You're Probably Getting Screwed by State Legislators

States have a critical role in fighting monopoly power.

Welcome to You’re Probably Getting Screwed, a weekly newsletter and video series from J.D. Scholten and Justin Stofferahn about the Second Gilded Age and the ways economic concentration is putting politics and profits over working people.

Have you contacted your state legislator recently about monopoly power? You should, because states can do a lot to protect us from corporate monopolies.

From the video:

You can find this week’s edition of Boondoggle here.

RSVP for this event next week on state antitrust policy.

Check out this resources page that includes several state antimonopoly toolkits.

Video clips are from Chair Khan’s “fireside chat” at the Brookings Institute this week.

YOU’RE PROBABLY (ALSO) GETTING SCREWED BY:

Homeowner Insurance

UNlike a good neighbor, State Farm is NOT there…

Military Spending

Jeff Stein, of the Washington Post, breaks down the latest Military spending that Congress passed and what we could do with that money in other places. Spoiler alert: we could do so much to help improve our lives!!!

Wholesale Liquor

Ron Knox of the Institute for Local Self Reliance has a great piece in The Nation on the FTC’s Robinson-Patman Act lawsuit against Southern Glazer’s Wine and Spirits and the broader signal this case could send.

“On its face, the case could restore much-needed competition to the retail liquor industry. But it’s also about something far bigger: the FTC’s attempt to restore a fundamental principle of fairness to our economy. For decades, big retailers have been allowed to dominate simply by virtue of their size, exploiting their power to strong-arm suppliers and crush smaller competitors. By reviving the Robinson-Patman Act, the FTC is signaling a bold move to undo the damage—to level the playing field, protect small businesses, and ensure that economic power isn’t concentrated in the hands of a few dominant players.”

Landlords

First, AI is costing renters billions! From the Council on Economic Advisors:

“Housing costs remain one of the biggest challenges for many American households. While the root cause of high housing costs is the under-supply of housing, insufficient competition in the housing industry exacerbates the costs significantly. In this CEA analysis, we quantify the anticompetitive impact of algorithmic pricing on rents across the country to demonstrate how households are harmed when competition in rental housing is weakened. We find that anticompetitive pricing costs renters in algorithm-utilizing buildings an average of $70 a month. In total, we estimate the costs to renters in 2023 was $3.8 billion. This estimate is likely a lower bound on the true costs.”

Second, the U.S. Justice Department is suing several large landlords for allegedly coordinating to keep Americans’ rents high by using both an algorithm to help set rents and privately sharing sensitive information with their competitors to boost profits.

Income Inequality

Credit Scores

What goes into a credit score? Jack Corbe deserves an Oscar for these NPR videos!

Oil Companies

Oil Companies are set to pay a record gun-jumping (illegal coordination) fine to the FTC for violating antitrust laws! XCL Resources, EP Energy, Verdun Oil have been hit with a $5.6 million penalty for unlawful coordination that led to a crude oil supply shortage. While the U.S. was facing shortages and high oil prices, these companies coordinated to limit supply and further drive up costs.

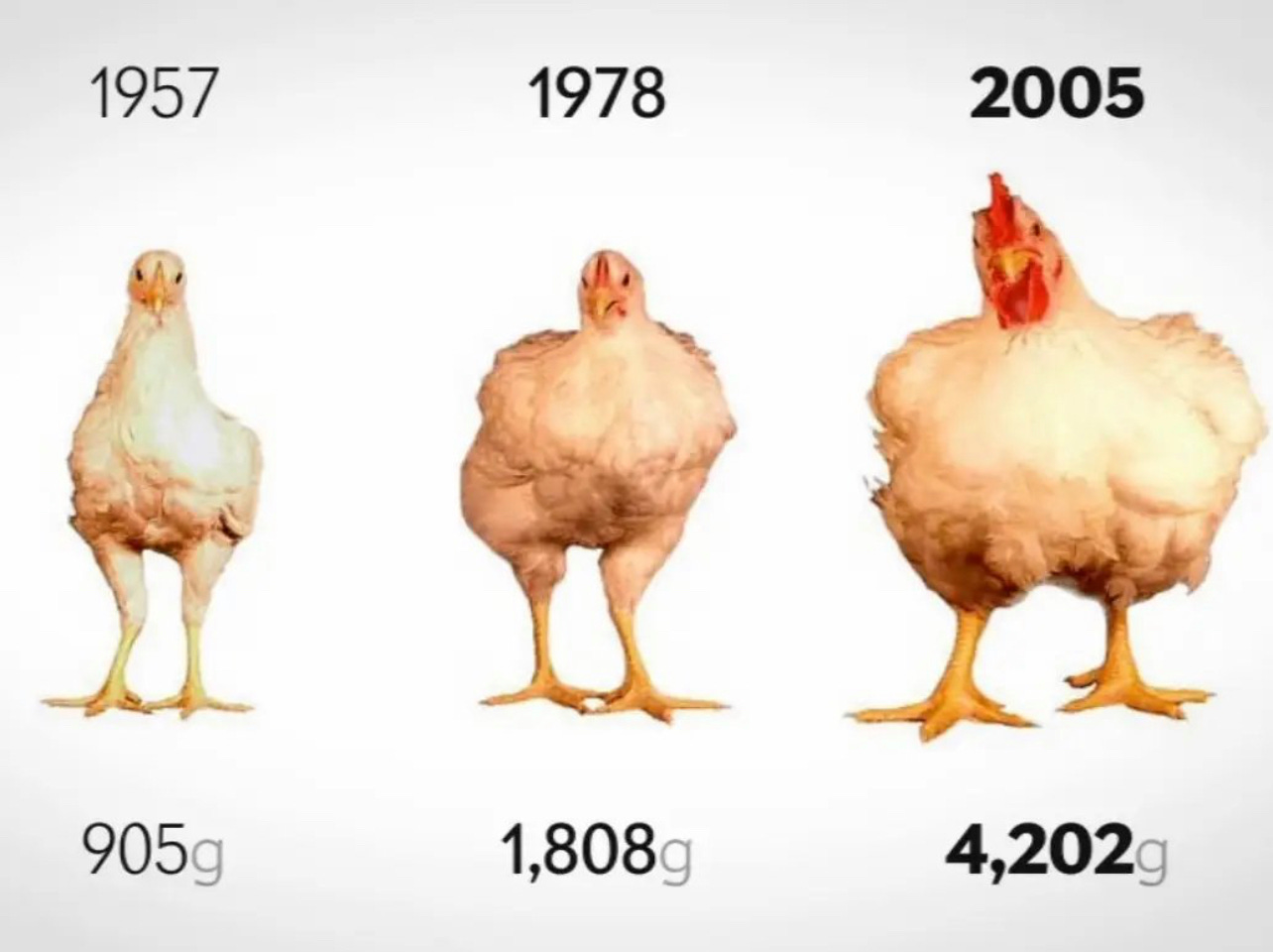

Chicken

The chicken you are eating has increased 364% in size over the last 50 years.

Here is an interesting thread of what this means for your health.

Arby’s

Arby’s may have “the meat,” but some customers have beef…

A class action lawsuit against Arby’s accuses the company of reducing the size of its french fries and drinks without lowering prices or alerting customers.

“Arby’s deceptively continues to sell its fries and beverages in smaller sizes which are now substantially smaller than the old sizes,” the suit, filed in Queens County Supreme Court, alleges.

Good News

Medical Bills Removed from Credit Reports

The Consumer Financial Protection Bureau (CFPB) finalized a rule that will remove an estimated $49 billion in medical bills from the credit reports of about 15 million Americans.

CFPB Has Our Back

CFPB is suing Experian for sham investigations of credit report errors!

“Experian does not properly investigate disputes and fails to remove or reinserts errors on reports, threatening consumers’ access to credit, employment, and housing.”

BEFORE YOU GO

Before you go, I need two things from you: 1) if you like something, please share it on social media or the next time you have coffee with a friend. 2) Ideas, if you have any ideas for future newsletter content please comment below. Thank you.

Break ‘Em Up,

Justin Stofferahn

Instead of chickens, they should show USA citizens getting bigger over the last six decades due to all the sugar and ultra processed food that industry has provided.

Please investigate the actual amount, availability, and use of “organic soybeans.”. As a steady consumer of supposedly organic soymilk, I’ve begun to wonder if some of it is not organic, as the percent of the soybean crop here that is dedicated to organic farming seems lower than the amount of product on the market would indicate.

Thank you for your good work.

Donna Davis in Cedar Falls, IA